What are Oversold Stocks?

Oversold stocks are Identified using Relative Strength Index .Relative Strength Index (“RSI“) is a financial technical analysis momentum oscillator measuring the velocity and magnitude of directional price movement by comparing upward and downward close-to-close movements. It was first introduced by Welles Wilder in an article in Commodities (now known as Futures) Magazine in June, 1978.

The Relative Strength Index is a price-following oscillator that ranges between 0 and 100. It is a mathematical measure that can indicate whether a particular stock is being undervalued or overvalued.

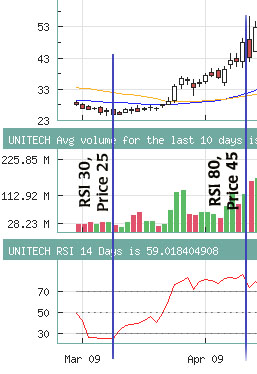

For Instance, consider UNITECH on of the most popular stocks on NSE. Unitech was trading around 25rs in start of March’09 with an RSI around 15-20, this indicated that the Stocks is oversold. Once the RSI crossed 30 on 12th March’09, the stock zoomed from 25rs to 45-47rs in Mid April ’09.

This is very helpful as it helps a Trader to know when to buy a stock. It should also be remembered that the stock might trade in the Oversold (below 30) zone for any number of days, sometimes even months. While the general wisdom is that the RSI of an overvalued stock is 70 or greater and the RSI of an undervalued stock is 30 or less, the novice trader may want to use a broader range, like 80 and 20 to avoid acting prematurely.

Just because an RSI hits 30 or 70 doesn’t mean it is about to turn the other way. With RSI values, it is a good idea to watch the volumes traded when the RSI “sticks” around 30 or 70 for a while. That will help determine whether traders are starting to book down profits or whether interest in buying a low RSI stock appears to be increasing.

On NSEGUIDE we provide you with a list of Oversold Stocks that have a Rising RSI, i.e the RSI of the stock has crossed above 30 levels, and seems that the stock might see some upward movement. This list displays all those stocks who’s RSI on the previous trading day was bellow 30, and the current RSI is above 30. This indicates that the RSI of the stock is rising and the stock looks strong Technically.

28 Responses

{ ADD YOUR OWN }Leave a Reply

Subscribe to Comments feedLatest Query

- by Sam

Search Our Archives

Research Desk

- Stocks Trading above their 50 day moving average - DMA In Stock Research

- Download free Ebooks based on Technical Analysis In Personal Training

- TOP 100 Stocks with the Highest P/E as on July 14th, 2013 In Stock Research

- TOP 100 Stocks with the Lowest P/E as on July 14th, 2013 In Stock Research

- Charting Pathsala - Your guide to Techincals In Technical Analysis

CB Says:

July 28th, 2010

Posted at: 12:01 am

Hi PC JAIN, in this case too its overbought.

good_citizen Says:

September 11th, 2010

Posted at: 1:15 pm

how we can know current value of RSI of any selected stock easily ?

CB Says:

September 11th, 2010

Posted at: 1:24 pm

Hi good_citizen, you can check it here: http://nseguide.com/charts.php?symbol=NIFTY

kan Says:

August 9th, 2011

Posted at: 6:25 am

hi guide me to see live chart quotes .....

milind Says:

January 17th, 2012

Posted at: 10:21 pm

pls advise whether I can by IGL now as it has fallen. RSI also low.

ramesh gupta Says:

August 18th, 2013

Posted at: 9:19 am

i have purchased hanung in nse for rs 80/- arround in june & july 2013 today it comes 20/- what can do sell or buy

Abi Says:

August 15th, 2014

Posted at: 6:27 pm

Thank you sir.

Deepak Desai Says:

February 3rd, 2015

Posted at: 10:08 am

Hello CB, i am here to thank you for your hard work, you are the best. :)

Amulya Kudchadkar Says:

May 12th, 2015

Posted at: 7:23 pm

what is yr view on ITC

Amulya Kudchadkar Says:

May 12th, 2015

Posted at: 7:24 pm

don,t BUY / sell any stock uNLESS YOU SEE TECNICAL CHART & BOLLINGER BAND

Amulya Kudchadkar Says:

May 12th, 2015

Posted at: 7:28 pm

DONT BUY ANY STOCK WITHOUT SL.IT IS SMALL BUT WILL SAVE YOU FROM CATASTOPIC EVENT.

I HOPE YOU KNOW THIS MARKET IS RIGGED ALL THE TIME

Alok Says:

December 25th, 2015

Posted at: 6:47 am

25-th Dec'15:-A stock with 315 Rs. is 52-weeks high & Low 13.

CMP 14 Rs., do buy the STOCK TGT 34...36...39 Contact me @#Alwaysthebeststock

Krishna Says:

April 29th, 2017

Posted at: 10:21 am

Hello Sir,

I am new to share market. I have very less investment and trying to gain small profits by doing intraday equity trading.

how can i identify in which share i have to do trade for the day.

Please advise.

Thank you in advance.

sathavahana Says:

February 16th, 2018

Posted at: 7:16 pm

sir i bought natco pharma at 876 per share but it came now to 779 how much time must i Should wait