Promoters Buying Stocks NSE BSE

There are few companies available at attractive valuations and promoters of those companies are buying stocks of own ocmpanies from open market. Of the 2,023 companies which filed shareholding pattern for the quarter ended March 2009, as many as 549 companies have seen an increase in shareholding of the promoter group. At the same time, few of the promoters are selling stocks and reducing their stakes.

“The increase in promoters holdings is a clear signal of the value present in companies after the correction witnessed in their stock prices over the last few quarters,” said Hitesh Agarwal, head (Research) at Angel Broking.

Sebi rules allow promoters to increase their stake through the open market by as much as 5% every year. In some cases, stakes could have gone up due to a merger or a share buyback. Therefore, any shareholding increase of more than 5% means there has been an extra activity during the quarter like a merger or a share buyback.

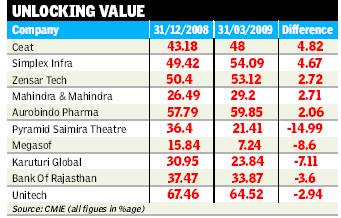

According to a data collated by CMIE, a number of companies has seen promoters hiking their stakes between 2% and 4% in the quarter. “In the case of Avery, the promoters increased their holding by 20% through to a public offer. Besides, a lot of promoters increase their stake to have a stronger holding in the company,” said K Ramakrishnan, executive director and head (Investment Banking) at Spark Capital. Companies like SREI Infrastructure Finance saw its promoters hike stake by 4.97%, Adlabs (3.68%), M&M (2.71%) and Zensar 2.72%.

“Sometimes promoters have had to increase their holdings to ward off takeover threats in wake of the low valuations. Nonetheless, generally, the act of increasing promoter holding in a company points to greater faith of the promoters in the company and also boosts shareholders’ confidence,” said Agarwal of Angel Broking. “

However, it is important to keep track of the fundamentals of the company and check the quantum of the hike and ensure that it is not merely a window dressing act.”Of all the companies which have filed the shareholding pattern, 1,314 companies did not see any change in their promoter holdings, while 160 companies saw a dip. The promoters of Karuturi Global dropped stakes by 7.11%, Bank of Rajasthan (-3.6%), Punj Lloyd (-2.78%), and scam-hit Pyramid Saimira saw its promoters holding drop by 14.99%.

Source: TimesBusiness

Tags: 52 week high, 52 week lows, account, accumulate, analysis, analysts, analysts poll, announcement, arbitrage, balance sheet, bear, bearish, Bombay stock exchange, bonus, book building, book closure, book running lead manager, broker research reports, brokers corner, bse, bull, bullish, buy, buy signals, chart, chat, cnbc India, cnbci, company, company information, company results, corporate, crash, crossovers, derivative, directors, dividend, double tops, equities, equity, expert, expert speaks, fii, finance, financial, fund manager, futures and options, graph, half yearly results, HOLD, index, index composition, india, industry, industry classification, infosys, initial public offer, internet trading, investment, IPO, ipo analysis, IPO FAQs, ipo finance, ipo grievances, ipo rating, IPOs, issue close, issue open, issue price, lead manager, learn stock trading, listed issues, listing, live market map, MACD, map, market, market statistics, merchant banker, mf ipos, mf issues, most active, moving average analysis, mutual fund ipos, national stock exchange, new issues, news, nifty, nse, oversubscribed, performance, Pharma, pivot point, pre-market analysis, price, price band, profit and loss, promoters buy sell stocks, Promoters holding, Promoters share in stocks, Promoters share of stocks in 2009, promotor, PSUs, public offer, quarterly results, quotes, rally, ratios, recommendation, record date, red herring prospectus, registrar, reliance, research, resistance, rights, run, satyam, scrip, scrips, sectors, sell, sell signals, sensex, share, share price ticker, shares, slump, split, stats, stock, stock analysis, stock breakdown, stock breakout, stock exchange, stock indicators, stock market, stock market analysis, stock market commentary, stock prediction, stock resistance level, stock support level, stock tips, stock trading, stock volume, stocks, stop loss, subscription, Support, technical, technical resistance, technical support, technology, top gainers, top losers, trading, trading systems, trading tips, triple tops, udayans stocks, upcoming issues, valuation, value, views, volume, wipro

Similar Posts:

Latest Query

- by Sam

Search Our Archives

Research Desk

- Stocks Trading above their 50 day moving average - DMA In Stock Research

- Download free Ebooks based on Technical Analysis In Personal Training

- TOP 100 Stocks with the Highest P/E as on July 14th, 2013 In Stock Research

- TOP 100 Stocks with the Lowest P/E as on July 14th, 2013 In Stock Research

- Charting Pathsala - Your guide to Techincals In Technical Analysis