What are Overbought Stocks?

Overbought stocks are Identified using Relative Strength Index .Relative Strength Index (“RSI“) is a financial technical analysis momentum oscillator measuring the velocity and magnitude of directional price movement by comparing upward and downward close-to-close movements. It was first introduced by Welles Wilder in an article in Commodities (now known as Futures) Magazine in June, 1978.

The Relative Strength Index is a price-following oscillator that ranges between 0 and 100. It is a mathematical measure that can indicate whether a particular stock is being undervalued or overvalued.

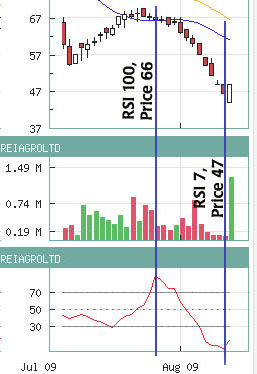

For Instance, consider REI Agro on of the most popular stocks on NSE. Rei Agro was trading around 66rs in end of July’09 with an RSI around 95-100, this indicated that the Stocks is highly Overbought. Once the RSI crossed 70 on 31st July’09, the stock dipped from 67rs to 45-47rs within a matter of few days.

For Instance, consider REI Agro on of the most popular stocks on NSE. Rei Agro was trading around 66rs in end of July’09 with an RSI around 95-100, this indicated that the Stocks is highly Overbought. Once the RSI crossed 70 on 31st July’09, the stock dipped from 67rs to 45-47rs within a matter of few days.

This is very helpful, as it helps a Trader to know when to buy a stock. It should also be remembered that the stock might trade in the Oversold (below 30) zone for any number of days, sometimes even months. While the general wisdom is that the RSI of an overvalued stock is 70 or greater and the RSI of an undervalued stock is 30 or less, the novice trader may want to use a broader range, like 80 and 20 to avoid acting prematurely.

Just because an RSI hits 30 or 70 doesn’t mean it is about to turn the other way. With RSI values, it is a good idea to watch the volumes traded when the RSI “sticks” around 30 or 70 for a while. That will help determine whether traders are starting to book down profits or whether interest in buying a low RSI stock appears to be increasing.

On NSEGUIDE we provide you with a list of Overbought Stocks that have a falling RSI, i.e the RSI of the stock has crossed below 70 levels, and seems that the stock might see some downtrend. This list displays all those stocks who’s RSI on the previous trading day was above 70, and the current RSI is below 70. This indicates that the RSI of the stock is falling and the stock looks weak Technically.

Leave a Reply

Subscribe to Comments feedLatest Query

- by Sam

Search Our Archives

Research Desk

- Stocks Trading above their 50 day moving average - DMA In Stock Research

- Download free Ebooks based on Technical Analysis In Personal Training

- TOP 100 Stocks with the Highest P/E as on July 14th, 2013 In Stock Research

- TOP 100 Stocks with the Lowest P/E as on July 14th, 2013 In Stock Research

- Charting Pathsala - Your guide to Techincals In Technical Analysis

17 Responses

{ ADD YOUR OWN }